Intel Q3 profit beats Wall Street estimates as strategic cost cuts, workforce reductions, and major investments boost revenue. Stock surges 8% after strong earnings report.

Intel has delivered an impressive financial performance in the third quarter of 2025, surpassing Wall Street expectations and signaling a strong recovery. The company reported adjusted earnings of $0.23 per share, well above the anticipated $0.02, and revenue of $13.7 billion, a 3% increase compared to the same period last year. This marks Intel’s first profit since 2023 and a significant rebound from the $17 billion loss experienced in the previous year.

The positive results were driven by strategic cost-cutting measures, including workforce reductions and project streamlining, alongside substantial investments from major partners. Nvidia contributed $5 billion, SoftBank invested $2 billion, and the U.S. government acquired a 10% stake for $8.9 billion. These financial moves have strengthened Intel’s position in the semiconductor industry, giving the company flexibility for growth and innovation.

Investors responded enthusiastically, with Intel’s stock surging over 8% in after-hours trading. Looking ahead, Intel forecasts continued revenue growth and solid earnings in the fourth quarter. This performance demonstrates the effectiveness of Intel’s strategy and positions the company for sustained success in a competitive semiconductor market.

Table of Contents

Intel Q3 Profit Beats Estimates with Cost Cuts and Strategic Investments

Intel has reported a remarkable turnaround in its Intel Q3 profit, surpassing Wall Street expectations for the third quarter of 2025. The semiconductor giant posted adjusted earnings of $0.23 per share, far above the anticipated $0.02 per share, while revenue reached $13.7 billion, a 3% increase year-over-year. Analysts had projected $13.16 billion, making this a notable earnings beat. (Tipranks.com)

Intel Q3 Profit Driven by Strategic Cost Cuts

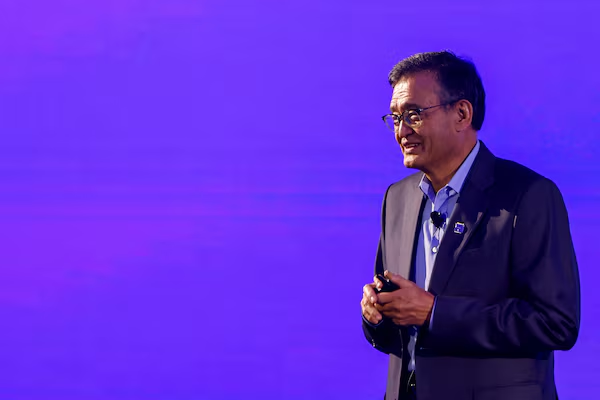

The turnaround is largely attributed to strategic cost-cutting measures implemented by CEO Lip-Bu Tan. These included workforce reductions, project cancellations, and streamlining operations to improve efficiency. Intel’s management emphasized that these changes were necessary to restore profitability and strengthen the company’s position in the competitive semiconductor industry.

This approach has clearly paid off, as Intel achieved its first profit since 2023, recovering from a $17 billion loss in the same quarter the previous year.

Major Investments Support Revenue Growth

The company also benefited from significant strategic investments, enhancing financial stability and operational flexibility. Intel secured $5 billion from Nvidia, $2 billion from Japan’s SoftBank, and a historic $8.9 billion investment from the U.S. government, which acquired a 10% stake in the company. These investments have bolstered Intel’s balance sheet, enabling continued R&D in advanced semiconductor technologies.

Stock Market Reaction to Intel Q3 Profit

Following the earnings announcement, Intel Q3 profit results sent shares soaring over 8% in after-hours trading, reflecting strong investor confidence. Market analysts praised the company’s proactive measures, noting that Intel’s combination of operational efficiency and strategic partnerships sets the stage for continued growth in the coming quarters. (Investopedia.com)

Looking Ahead: Intel Q4 Forecast

Looking forward, Intel expects fourth-quarter revenue between $12.8 billion and $13.8 billion, with adjusted earnings of $0.08 per share, aligning closely with analyst expectations. CEO Lip-Bu Tan remains optimistic about the company’s strategic direction, emphasizing continued innovation and efficiency in semiconductor manufacturing.

Analysts also highlighted that Intel’s partnerships with key players like Nvidia and SoftBank, combined with government support, give the company a unique advantage as global demand for advanced chips grows.

Implications for the Semiconductor Industry

Intel’s Q3 profit highlights a broader recovery in the semiconductor industry, showing that even legacy companies can rebound with smart cost management and investment. The strong performance demonstrates that Intel is positioned to compete effectively with rivals while continuing to innovate in AI chips, data centers, and consumer electronics.

Conclusion: Intel Q3 Profit Signals Strong Recovery

The Intel Q3 profit beat marks a critical milestone in the company’s financial turnaround. Through strategic cost-cutting, key investments, and strong operational management, Intel has returned to profitability and regained investor confidence. As the company moves forward, its focus on innovation and efficiency is expected to continue driving growth in the competitive semiconductor landscape.

External Links

- Intel beats third-quarter profit estimates as cost cuts, investments pay off – Reuters

- Intel posts profit even as it struggles to regain market share – AP News

- Intel Stock Soars as Chipmaker Swings to a Profit – Investopedia

Tags :

Intel, Intel Q3 profit, semiconductor industry, earnings report, Lip-Bu Tan, Intel revenue, cost-cutting, stock surge, Nvidia investment, SoftBank, US government, semiconductor news, financial news, Intel stock, tech earnings